HELOCs and you can home collateral funds each other succeed people so you’re able to tap into collateral. not, you will find several key differences when considering those two selection.

Domestic Security Loan versus. HELOC

HELOC play the role of a readily available line of credit, nevertheless family equity loan happens given that a swelling-share payment. On top of that, HELOCs has actually flexible installment terminology, however, domestic equity financing possess a predetermined payment plan eg an excellent financial. Sometimes, that it lay agenda helps you stop last balloon payments, and therefore HELOCs can sometimes carry.

Based whether or not interest rates are often ascending or shedding, the home collateral mortgage interest rate could be highest or down than just an excellent HELOC. Cost together with vary according to mortgage installment terms and conditions https://paydayloanalabama.com/geneva/ therefore the loan’s matter in comparison to the full domestic collateral.

Attract paid towards a home guarantee loan observe the same guidelines getting HELOC focus deductions detailed over, for instance the limitation to the complete financing well worth and rehearse of your fund.

Almost every other HELOC Tax Factors

When subtracting the interest reduced into the a beneficial HELOC loan, you will need to continue thorough details away from the funds is regularly validate their deduction. You really need to make sure one money lent up against your own primary household meet the criteria off capital desire for usage against accommodations assets.

To possess blended-put attributes, remaining info you to validate the fresh allowance interesting between your house along with your leasing is key to dealing with any potential audits.

Even if HELOCs require cautious list-keeping. Although not, prospective deductions and additional liberty make them a stylish choice for home dealers. They give the means to access the newest equity in your functions that have improvement repayment conditions. The brand new varying rates of interest with the HELOCs shall be very carefully experienced in advance of with these people in order to tap the fresh new security on the property.

Extra cash-Preserving Tax Tips

We at the Common Savings Taxation can help you identify missed taxation deductions which will save you plenty on your own yearly taxation costs. Sign up for a single-on-one technique session having our income tax masters today to observe far you can save.

What you need to Learn

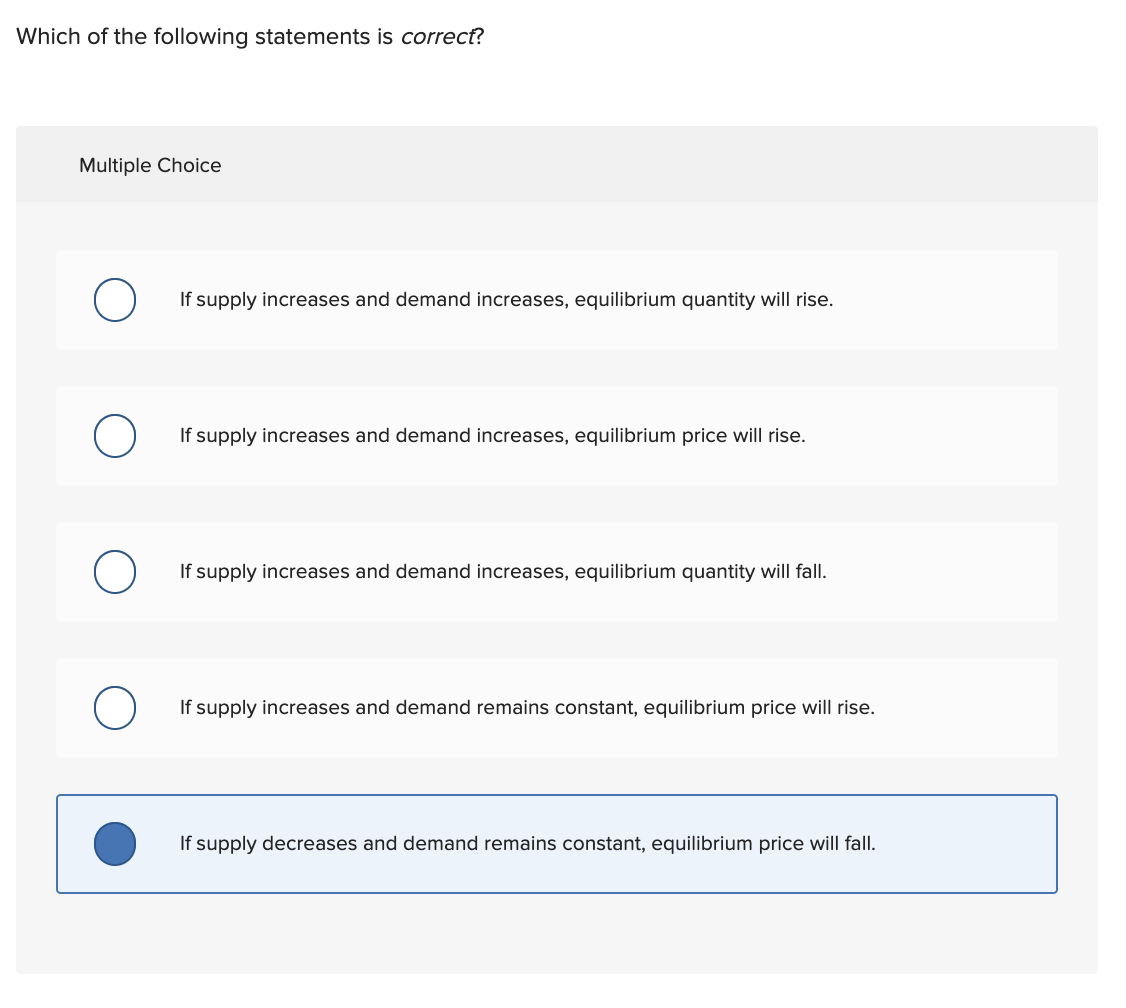

- Notice repaid into the family equity credit lines (aka HELOCs) often is tax deductible

- You can simply deduct focus payments with the HELOCs if you are using the bucks to own family home improvements

- The brand new income tax advantages to the HELOCs appear only to individuals who already itemize their deductions

Articles

Require some more cash having property fix and get security of your house? You might look at a property security loan otherwise a house equity personal line of credit, known as a HELOC. Both are next mortgages and you can they are both great alternatives.

You will find specific differences when considering a house security loan and you can a good house collateral personal line of credit. The main distinction would be the fact a house security mortgage was a fixed-price loan for a set amount, and you may a beneficial HELOC is a rotating personal line of credit (including credit cards) that usually enjoys a variable price. One kind of real estate loan are finest based on your condition and you will what you want the bucks having.

Scraping either one not simply assists fund any project it may in addition to result in a plus during taxation 12 months. Interest paid towards HELOCs often is tax-deductible.

Home equity financing appeal and you may HELOC appeal is actually each other tax deductible, however, just less than specific affairs. It is important to learn the the inner workings before you claim HELOC or household guarantee financing attention on your fees.

This new Guidelines to own HELOC Desire Taxation Deduction

Into 2017, the newest Irs altered the principles about income tax deductions on interest to have HELOCs. They offered the fresh statutes so you can and connect with HELOCs pulled out before 2017. The latest determining reason behind if or not HELOC interest try tax-deductible is actually how you make use of the dollars throughout the HELOC.