While you can manage your own accounting during the initial stages of your small business, it’s best to make the investment in a qualified, professional bookkeeper to ensure your success in the long term. If you have mistakes https://www.kelleysbookkeeping.com/ to fix or transactions to track down, don’t stress. Most of the time, a qualified professional can correct or document these errors. Never leave the practice of bookkeeping (or your business assets) to chance.

Will you require catch-up bookkeeping services?

Even if a bookkeeping service has all of these add-ons, they can be expensive, so be sure you understand the total cost before choosing a service. Small-business bookkeeping is the process of accurately recording your business’s financial activity. When bookkeeping tasks become too time-consuming to handle on your own, hiring an online bookkeeping service can be a worthwhile investment.

Bookkeeping Basics for Small Business Owners: Everything You Need to Start Doing Your Own Bookkeeping

Learners are advised to conduct additional research to ensure that courses and other credentials pursued meet their personal, professional, and financial goals. A lot goes into it—from managing payables and receivables to balancing books. But what might seem like an overwhelming task isn’t so bad when you break it down to the bookkeeping basics. Here’s a crash course on small-business bookkeeping and how to get started. Our partners cannot pay us to guarantee favorable reviews of their products or services. Now that you have a better understanding of bookkeeping, you may be wondering if it’s something you want to take on yourself or with the help of a professional.

Run your business with confidence

Only an accountant licensed to do so can prepare certified financial statements for lenders, buyers and investors. However, your bookkeeper can generate internal management reports for your business. Bookkeepers manage a company’s financial accounts, ensuring they are accurate and easy to review.

Methods of bookkeeping

Take routine bookkeeping off your never-ending to-do list with the help of a certified professional. A QuickBooks Live bookkeeper can help ensure that your business’s books close every month, and you’re primed for tax season. Our expert CPAs and QuickBooks ProAdvisors average 15 years of experience working with small businesses across various industries. The single-entry https://www.intuit-payroll.org/debits-and-credits/ bookkeeping method is often preferred for sole proprietors, small startups, and companies with unfussy or minimal transaction activity. The single-entry system tracks cash sales and expenditures over a period of time. Without bookkeeping, accountants would be unable to successfully provide business owners with the insight they need to make informed financial decisions.

- Under cash accounting, you record transactions only once money has exchanged hands.

- The system you choose to use doesn’t need to be complicated and the ledgers should be straightforward, especially if you have just a few or no employees.

- Business transactions can be recorded by hand in a journal or an Excel spreadsheet.

- Though you may not work regularly with a tax specialist year-round, you’ll want to connect with one sooner rather than later so you’re not rushed come tax time.

Take courses or complete a professional certificate.

This means that you don’t record an invoice until it is actually paid. Similarly, you don’t notate outstanding bills until you actually pay them. This method offers a true snapshot of your assets and debts at any given time. Bookkeepers are integral to ensuring that businesses keep their finances organized.

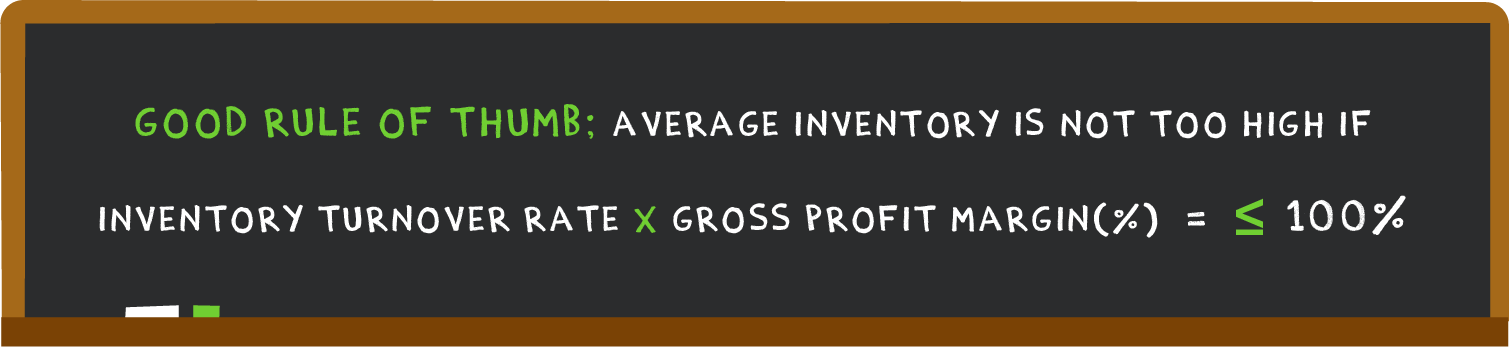

Balance sheet accounts are assets, liabilities, and stockholder or owner equity. Income statement accounts are operating and non – operating revenues, expenses, gains and losses. When selecting special revenue fund procedures a bookkeeping style, business owners have several options. Learn how QuickBooks Live Expert Assisted can help you streamline your bookkeeping and free up time spent on finances.

If you’re like most modern business owners, odds are you didn’t become one so that you could practice professional-level bookkeeping. Outsourcing the work to a seasoned bookkeeper can allow you to focus on your business plan and growth. Bookkeeping is just one facet of doing business and keeping accurate financial records. With well-managed bookkeeping, your business can closely monitor its financial capabilities and journey toward heightened profits, breakthrough growth, and deserved success. Flat rate of $190 per month is more affordable than other bookkeeping services.

In this module, you’ll be introduced to the role of a bookkeeper and gain an understanding of how to use the accounting equation and double-entry accounting. Every transaction you make needs to be categorized when it’s entered in your books. This helps your bookkeeper catch more deductions, and will make your life easier if you get audited.

You should begin monitoring prices for your desired destination three to four months in advance, depending on when your (and your family’s) time off falls. If you are already looking ahead to next summer, Hopper recommends monitoring flight prices at least three to four months in advance and then booking one to two months before the intended travel date. Weaver pushed the change during a time when education has become increasingly politicized.