Experts have access to of a lot capital ventures through the Va, in addition to probably one of the most popular financial software known as new Virtual assistant financial. As the its the start, so it mortgage system have helped some experts get belongings and take advantage of the many benefits of homeownership.

If you are looking to acquire a flat otherwise the new build property, it could be hard to pick financing if you don’t have 20% down. Thank goodness, the fresh new Agencies of Veterans Situations (VA) brings individuals software that assist make process much easier, like the Va mortgage program, which allows experts and you can eligible provider people to invest in their houses and no money down.

Are you to shop for new construction or condominium having fun with a great Virtual assistant loan? If so, its required to recognize how the applying works with that this possessions sort of and get conscious of any possible facts you could encounter in the process. Read on for more information on buying condos and you may the build residential property with Va funds.

Virtual assistant Loans and Apartments

New Virtual assistant financing schools are prepared around allow experts to help you get residential property compliment of authorities-secured funds. Va financing are a good choice if you are looking to shop for a condo. This is because simple: A great Va mortgage allows experts in order to borrow 100% of the cost with no downpayment. When you’re Virtual assistant money work effectively having apartments, you will find several unique laws you should know throughout the.

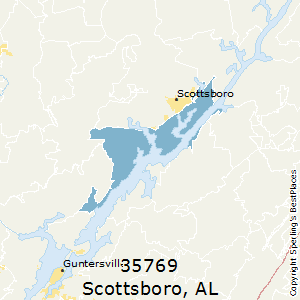

Specific limits can impact the price of a flat depending on the latest housing industry together with size you want to to shop for. The new Virtual assistant mortgage schools has actually obvious guidance from the which services be considered on the pick program and you can that don’t. However, already, of a lot condo advancements over the condition take the brand loan places Arab new Virtual assistant-accepted number. You can check in case your well-known condo try Va-approved from the VA’s online condo databases.

Can you imagine brand new Condo Is not an excellent Va-Acknowledged Creativity?

If you are considering buying a condo on Va financing, your ent isn’t really one of the approved qualities. Although this is an unfortunate problem, you can still find how to get up to they and get new condo need without having to worry in the investing extra charge or dropping currency down the road when you look at the improved attention costs on your own loan.

The initial step is to try to reach finally your financial and you can tell them that you will be to find an apartment. Have them seek Virtual assistant acceptance before signing your purchase. This is done by filing a keen underwriting memorandum that lists every of related guidance and you can certifies it meets every standards having recognition. This may involve:

- Report out-of covenants, standards, and you may limits

- Plat, chart, or air lot survey

- Homeowner relationship bylaws and you can budget

- Minutes the past several citizen connection conferences

- Special monitors and you can legal actions report

Essential note: Condo advancements aren’t obligated to deliver the approval paperwork. Dont be prepared to rush regarding recognition procedure if you want a swift closing. The fresh Virtual assistant officials tend to remark the fresh new paperwork and your lender’s request and you can agree otherwise refute brand new quote. They will as well as aware the financial institution from lost details or any other factors which are often amended in order to meet the acceptance standards.

Virtual assistant Fund and you can The Buildings

For folks who served on army, an effective Virtual assistant mortgage can help you find the resource you desire to order otherwise build a unique build possessions while maintaining their monthly installments reasonable and also qualifying you for additional pros. Virtual assistant funds offer several benefits more than traditional mortgages, along with faster interest levels with no down-payment conditions.

People are not aware that Department off Experts Situations even offers mortgage loans and work out strengthening the fresh new land even more obtainable and much more sensible than just they’d feel otherwise. not, the sort of financial you decide on depends on multiple products, along with how you propose to money any project and you may if or not you must live in the home otherwise rent it out just after structure is finished.

A possible debtor have to meet up with the exact same credit, residual income, debt-to-money, certainly most other conditions the same as a seasoned to acquire a new family.

You should buy a houses financing out-of a neighborhood lender or creator as a professional seasoned. After that re-finance the brief-label build loan to your a long-term Va home loan since your house building opportunity wraps up.

You need to use Pros Joined to help discover a good Virtual assistant bank happy to convert the newest small-name construction mortgage into the a long-name Va mortgage.

- The house need get an effective Va appraisal, and you will designers need to have a good Va Creator ID.

Summary

Are you currently an experienced having supported regarding army any moment over the past 10 years and has now an respectable release? If so, you will be entitled to a certain Virtual assistant financing restriction to help you funds your future family-whether it’s to acquire a condo otherwise building the latest design. Making it vitally important to learn just how Virtual assistant funds operate in those two situations, given that chatted about in this article.